- (210) 987-6543

- [email protected]

- San Antonio, TX

Ensure your assets are protected, avoid probate, and provide clear instructions for your loved ones with a revocable living trust.

Take control of your assets and ensure your loved ones are cared for easily. Creating a Revocable Living Trust protects your estate while avoiding probate and minimizing legal complications. Our user-friendly online platform makes setting up your trust simple and stress-free.

Just provide the necessary details, and you’ll have a legally binding document ready in minutes. No confusing forms or lengthy processes—just an efficient way to safeguard your legacy. Secure your family’s future and enjoy peace of mind, knowing your assets are managed exactly as you wish—all from the comfort of home.

You can fill out your will forms online at your convenience—no waiting for appointments.

Once you complete the forms, a licensed attorney will review your will for accuracy and compliance.

You can update your will whenever your circumstances change, ensuring it’s always up-to-date.

Complete your estate planning forms from the comfort of your home.

Begin by completing our intuitive online form with the necessary details for your estate planning document. It’s simple and guided, making sure you provide all the relevant information.

Once you submit the form, our platform automatically generates your legal document based on the information you provided. The document is tailored specifically to your input.

After the document is generated, you can download it to your device. You will need to fill in any remaining sections manually, ensuring all required details are complete.

Finally, sign your completed document and scan it. Once signed, simply send it back to us for review, ensuring everything is in order.

A Revocable Living Trust is a flexible legal tool that helps you manage your assets during your lifetime and ensures a smooth transfer to your loved ones after you’re gone—without the hassle of probate. Think of it as your personalized plan to protect your legacy while keeping control. The best part? You can update it anytime as your life changes. It’s a smart, stress-free way to secure your family’s future and enjoy peace of mind today.

Creating a living trust is a smart move! It helps you avoid probate, keeps things private, and makes managing your assets easier. Plus, it gives you control and peace of mind knowing your loved ones will have a smooth process when it matters most. It’s all about protecting your family’s future!

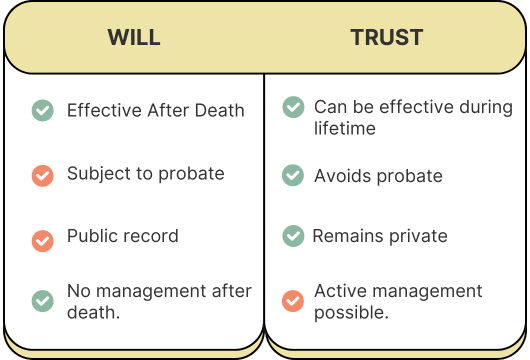

Both documents are essential tools in estate planning and can be used together for comprehensive asset protection and distribution

Texas Estate Forms is an online platform designed for Texans to easily create essential estate planning documents like wills, trusts, power of attorney (POA), and medical power of attorney (MPOA). Simplify the process with user-friendly tools tailored to Texas laws, ensuring peace of mind and protection for you and your loved ones.

Estate planning ensures your assets are managed and distributed according to your wishes after you pass. It protects your family, avoids legal disputes, and ensures important decisions are made if you’re incapacitated.

An estate plan typically includes a will, trust, power of attorney, medical power of attorney, and a transfer on death deed (TODD) for real estate.

A will directs how your assets are distributed after death and goes through probate. A trust allows assets to pass without probate and offers more control over when and how they are distributed.

A POA appoints someone to manage your legal and financial affairs if you’re unable to do so yourself due to illness or incapacity.

A TODD allows your property to transfer directly to heirs upon your death, bypassing probate and simplifying the process for your loved ones.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Lorem Ipsum is simply dummy text of the printing and typesetting industry.